Like any job or hobby, there are always tools of the trade. If you are just starting out on you dividend journey then your tools may be

books or other information sources like blogs. Maybe you are a little farther ahead in your journey than most. For the sake of this article lets say that you've already completed 6 months of reading and LEARNING before having decided to become a dividend investor. Where do you go from here?

Well there are many tools and resources to set you on your way. Primarily you will have to be able to research particular companies. Notice that I say

companies instead of

stocks. When investing you need to be whole heartedly committed to everything about a particular company. Look at their history and how they have treated their shareholders over the years. Have they constantly increased their dividend? Has the company participated in any recent share repurchase plans? How many years of consistent dividend payments has this company made? These are all questions you need to be able to ask yourself. When it comes to the actual buying and selling of shares you may already have a broker but thats not to say you shouldn't be interested in a different one. How much per trade do you you pay with your current broker? Or, if you do not have a broker, how much would you be willing to pay per trade? Finally, investing is quite the "to-do" as my Papa would put it. You need to have a way to organize your portfolio and keep track of everything you are doing.

For company research, portfolio organization, and stock screening I suggest :

Google Finance

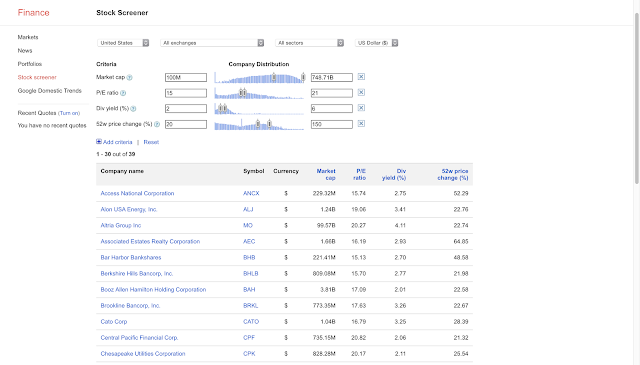

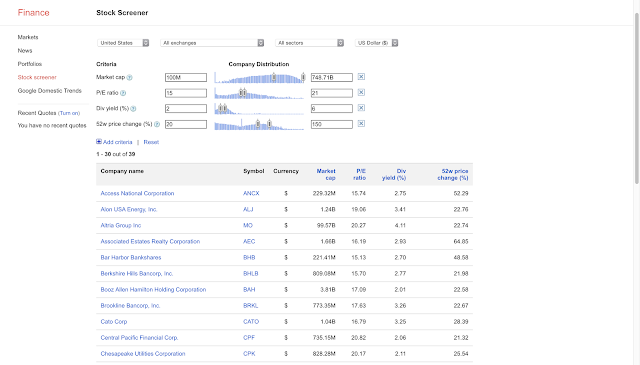

As you will see below, through Google Finance, you have access to charts, quick glance financial info, related companies, executives, key financials, and related news. It is very intuitive and best of all its FREE! I find the Google Finance Stock Screener particularly useful when searching for companies that contain specific attributes such as a low P/E ratio or above average dividend yield.

|

| No frills portfolio organization with the ability to view your holdings in many different detailed ways |

|

| Interactive charts by date ranges, and the ability to compare other tickers on companies homepages |

|

| Related companies, and company key dates such as shareholder meetings |

|

| Market and stock specific news from varying outlets |

|

| Stock screener with everything you could need to find your next purchase |

For your trading platform I suggest :

Robinhood App

If you have an iPhone or other Apple iDevice, Robinhood is perfect. Not only will you avoid any traditional fees associated with buy or sell orders, but Robinhood App's ultra simplistic interface keeps things easygoing. This is key for a new investor who is looking to invest small amounts of money at a time and not become overwhelmed with a complex trading platform. Robinhood App is currently working on a Web App version of their platform, as well as an android version! It needs to be stated though that currently Robinhood App is very feature light. Buy, sell, and transfer funds is about it. As a buy and hold investor this should be a non-issue.

If you do not have currently have an iDevice, I would suggest :

Interactive Brokers

Interactive Brokers has some of the cheapest commission rates around. This is key because you'll be able to deploy more of your money into a companies shares instead of someone else's wallet. Unlike Robinhood App, Interactive Broker is a full service broker that allows you to do anything that the big boys such as E-Trade or ScottTrade can.

What about you? What tools do you use on your own investing journey? Anything I left out? Let me know down below!

Thats it for now everyone. Blog readership is picking up now, (over 500 total views in 3 days) so expect an update every 3-4 days or so.

Div

I am a 21 year old kid who seeks to create a life of financial independence via passive income. The accumulation and growth of quality dividend yielding stocks will be the main source of income and this is my journey.

___

As I am getting back into the swing of things I decided to update the Div Kid portfolio. Check out the new info! Im glad Im able to get back to writing to you all. I find it relaxing to sit down and go over my finances. How many people can say the same?

As I am getting back into the swing of things I decided to update the Div Kid portfolio. Check out the new info! Im glad Im able to get back to writing to you all. I find it relaxing to sit down and go over my finances. How many people can say the same?