Recently I spent a decent amount of money on something that was not an income paying asset. Being home for the summer affords me a great opportunity to spend time with family and last Saturday I did just that. I have said before that instead of spending money on "things" it is important to spend money on experiences. To accrue experiences. This last weekend I made plans for me and my grandfather to visit LeMay, America's Car Museum in Tacoma, WA. While I can't put a value on the time I get to spend with my family being frugal is still sensible. On the day I spent $71.00. That includes the price of admission, lunch and the completely necessary ride on the F1 racing simulator. Not only was this money well spent, I would do it again in a moments notice.

Recently I spent a decent amount of money on something that was not an income paying asset. Being home for the summer affords me a great opportunity to spend time with family and last Saturday I did just that. I have said before that instead of spending money on "things" it is important to spend money on experiences. To accrue experiences. This last weekend I made plans for me and my grandfather to visit LeMay, America's Car Museum in Tacoma, WA. While I can't put a value on the time I get to spend with my family being frugal is still sensible. On the day I spent $71.00. That includes the price of admission, lunch and the completely necessary ride on the F1 racing simulator. Not only was this money well spent, I would do it again in a moments notice.

I skimp on "things" such as eating out for lunch, and buying unnecessary stuff to do exactly what me and my grandfather got to do. The money that I do spend is more often than not spent on things like this, and it truly makes me happy. I feel so guilty spending money that is not spent in a meaningful way. It is almost as if I am robbing my future self of a work free life.

I was in a similar situation just under a year ago. I came across a windfall of ~$1500 and had a multitude of ideas on how to spend the money but could not quite decide. After a few weeks, and many suggestions by friends, I decided to break from the norm and not go buy a new TV or game system. In the end I purchased a year long membership to the Arizona State University Men's Rowing Team and never looked back. I was even able to save a remaining $500! In exchange I competed in three states, six regattas, and gained a ton of exciting experiences. This situation was the definition of accruing experiences. Not only was I able to compete in a collegiate sport but I was able to participate in something I had never done or even considered doing. I now have wealth of team building, and competitive experiences that I would have never gained had I spend that $1000 on a new TV and video games.

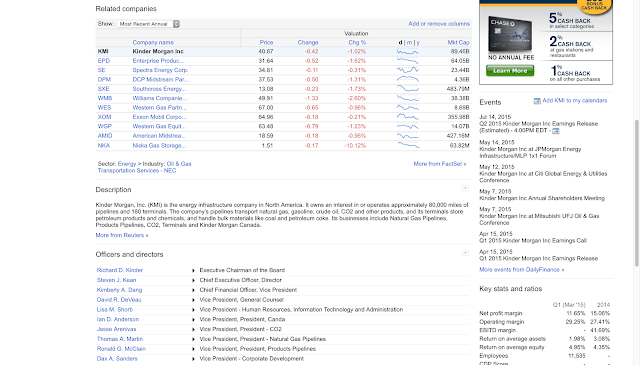

I tend to be very frugal and when I buy food for lunch or a new iPod I have a seriously hard time pulling the trigger. When I buy an income yielding asset like CVX and WMT stock, it is much easier. I know that money will be returned to me and I will be rewarded. It is a much different transaction in the end.

The moral of the story here is, pay yourself first. Resist the urge to buy the hot new thing that everyone needs. Buy things that are meaningful to you, whether thats a plane ticket home to see family or admission to a car museum with grandpa. Spend meaningful money.

I tend to be very frugal and when I buy food for lunch or a new iPod I have a seriously hard time pulling the trigger. When I buy an income yielding asset like CVX and WMT stock, it is much easier. I know that money will be returned to me and I will be rewarded. It is a much different transaction in the end.

The moral of the story here is, pay yourself first. Resist the urge to buy the hot new thing that everyone needs. Buy things that are meaningful to you, whether thats a plane ticket home to see family or admission to a car museum with grandpa. Spend meaningful money.

Have you spent any meaninguful money recently?

What meaningless money could you cut back on spending?

Do you consider meaningful vs meaningless purchases?

What meaningless money could you cut back on spending?

Do you consider meaningful vs meaningless purchases?

I am a 21 year old kid who seeks to create a life of financial independence via passive income. The accumulation and growth of quality dividend yielding stocks will be the main source of income and this is my journey.

___